CIS technology has a history of more than 30 years since its inception in 1993.

Especially since 2009, riding the wave of the mobile phone market, CIS has maintained growth year after year, ushering in an era where "CIS is everywhere gold."

Over the years, the market competition pattern of CIS has undergone several changes. Sony has become the leader in the market and technology, while Samsung and Omnivision remain strong. Domestic CIS manufacturers such as SmartSens and GalaxyCore are catching up, continuously narrowing the gap.

Recently, with the fluctuation and replacement of the industry cycle, CIS manufacturers have been continuously active.

Sony's new CIS production line in Thailand has expanded production, while being limited by its own wafer factory's capacity and yield, it has turned to cooperate with TSMC. Sony's CIS factory in Kumamoto Prefecture, Japan, will continue to cooperate closely with TSMC's joint venture JASM, which will provide Sony with the required logic chip capacity at its wafer factory in Kikuyomachi. In addition, Sony has also purchased factory land in Go Shi City, Japan, preparing to build a new CIS factory...

Advertisement

The Japanese Toppan Group has chosen to transfer its CIS production line to Shanghai, aiming to increase production capacity, optimize the supply chain, and ensure competitiveness in the global semiconductor market.

At the end of last year, the opening ceremony of GalaxyCore's production in Lin-gang, Shanghai, announced that GalaxyCore has made a magnificent transition from Fabless to Fablite, which also means that the turbulent CIS market has added a few more variables...

Behind the dynamics of the CIS market, two signals are released:

CIS expansion, market demand is rapidly recovering

Behind the series of movements of CIS manufacturers, on the one hand, it represents the recovery and rise of fields such as smart phones, smart cars, security, and industry, and emerging fields such as drones, AR/VR, and machine vision are also rapidly increasing in volume, and the CIS market is rapidly rising.Reflected in the capital side, Weier Shares, Geke Micro, and Sitewei, the three CIS manufacturers, have a large shipment, and the Q1 performance has grown strongly; the local wafer foundry "twin heroes" are busy with orders, SMIC and Huahong Semiconductor have successively stated in their financial reports that "the demand for CIS products has increased" and "the capacity is in short supply"...

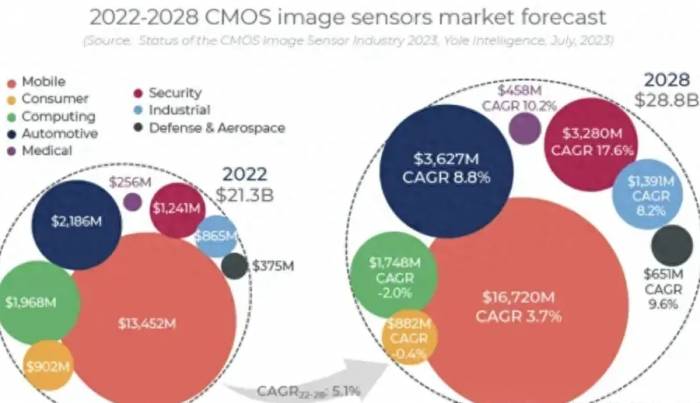

In recent years, the global CIS sales volume has shown a generally stable growth trend. According to Yole's data forecast, it is expected that by 2028, the global CIS market size will further grow to 28.8 billion US dollars, with a compound annual growth rate of 5.1% from 2022 to 2028.

The dispute between Fabless and IDM, Fablite becomes a trend?

On the other hand, the transformation of Geke Micro's business model may also mean that the product positioning has expanded from high cost-effectiveness to high performance, trying to further grasp the initiative and competitiveness in its own hands.

Looking at the development process over the years, the dispute between the Fabless and IDM models in the semiconductor industry has a long history, with each having its own strengths and weaknesses.

The prevalence of the Fabless model has enabled chip design companies to grow rapidly with a light asset model, but this outsourcing processing model has also brought uncertainty in supply chain management, especially when capacity is tight, the capacity guarantee tasks of wafer factories and packaging and testing factories have become the "nightmare" of every Fabless company's operation.

In addition, the cost price fluctuation of outsourcing processing is quite large, which has caused a significant impact on the gross profit of chip design companies. These are all great constraints for Fabless companies.

In recent years, under the conditions of the vigorous development of the domestic chip industry and the strong support of the country, with the accumulation of technical strength and the needs of industry development, many local Fabless companies have started to break through and gradually transform towards IDM.

Geke Micro has completed the transformation of its business model from Fabless to Fablite, and has opened up the entire link of design, research and development, manufacturing, testing, and sales. Geke Micro emphasizes that the Fablite business model helps to achieve the integration of resources in chip design and manufacturing, improve the design and process level in the field of back-illuminated image sensors, accelerate the industrialization of R&D results, and is conducive to enhancing the company's core competitiveness.According to previous news reports, as early as 2019, Weier Shares invested an additional $27 million in Howei to build a wafer testing and wafer restructuring production line. In 2020, Weier Shares planned to raise 1.839 billion yuan for the construction of the second phase of the wafer testing and wafer restructuring production line, mainly for the 12-inch wafer testing and packaging of CIS. (No subsequent progress or information has been disclosed)

At that time, in response to the necessity of building its own packaging and testing production line, Weier Shares stated: on the one hand, it can further enhance the company's competitive advantage in the field of CIS chips, reduce costs, improve control over products, and shorten delivery times; on the other hand, it can improve market response efficiency, which is conducive to seizing the opportunities in the CIS market and increasing market share; in addition, this is a decision that meets the needs of the company's strategic development, and the top global manufacturers all adopt the IDM model, which can integrate industrial chain resources and produce scale effects.

Based on a comprehensive analysis of the current industry status and the development stage of domestic manufacturers, the author believes that for Fabless companies, the transformation to a more flexible Fablite model will become a trend: on the one hand, the Fablite model can better control the capacity, quality, and reliability of products, and the product development cycle is more controllable; on the other hand, Fablite is generally focused on mature nodes, and compared with advanced technology nodes, less capital is required to maintain operations.

Therefore, the transformation of domestic Fabless manufacturers to the Fablite model is an inevitable path to break through the business scale and core technology level, ensure the safety of production capacity and supply chain, and achieve the domestic substitution of CIS.

The transformation from Fabless to Fablite may have the potential to lower the company's profits due to the capitalization of future interest and the increase in depreciation in the short term. However, in the long run, the independent production and manufacturing of the wafer process can increase profits, which will be an important opportunity for the company to showcase its own process level.

On the other hand, this will also drive the rapid development of the domestic equipment industry. As more and more domestic chip companies become more autonomous and controllable in the supply chain, it is expected to drive more domestic equipment manufacturers to stand out.

However, the author needs to emphasize that domestic Fabless manufacturers should also avoid blind expansion. When their own shipment scale is not large enough, and their own business is easily affected and has a large degree of instability, they should be cautious in controlling the pace of expansion and the degree of transformation.

This is because companies that adopt the IDM model are basically internationally renowned manufacturers with very strong technical and financial strength. IDM may be too heavy a burden for most Chinese chip design companies.

Some domestic chip companies have privately expressed to the author that due to the high cost of equipment depreciation and the large fluctuations in market demand, the company will reduce the scale and plan of its own production line in the future.

Therefore, gradually building a Fablite model of Fabless + manufacturing/testing/packaging, and exploring the ability to balance the advantages and disadvantages between Fabless and IDM models, is particularly crucial for domestic CIS manufacturers.Smartphone Market, Domestic CIS Manufacturers "Compete on Equal Terms"

Currently, the CIS market structure is rapidly changing.

Taking the smartphone market, where CIS applications account for more than 70%, as an example, in the second half of 2023, smartphone demand is moderately recovering, the CIS industry's inventory reduction is nearing completion, and domestic CIS manufacturers' new product breakthroughs continue to exceed expectations.

According to the preliminary shipment survey by Omdia, in the first quarter of 2024, the total global smartphone shipments amounted to 304 million units, a year-on-year increase of 11.6%, marking the second consecutive quarter of year-on-year growth after a long period of market stagnation and decline from the second quarter of 2021 to the fourth quarter of 2023.

With the recovery of terminal sales, the smartphone field has once again become a battleground for CIS manufacturers.

As we all know, Sony and Samsung are two mountains that cannot be ignored in the smartphone CIS chip industry. The former is not only the exclusive supplier of image sensors for the iPhone but also dominates the product supply for mainstream high-end Android models. The latter, backed by Samsung's mobile phones, has also made a fortune in the global market following Samsung's mobile phones.

According to research data from TechInsights, in the 14 billion US dollar market size of global smartphone CIS in 2023, Sony accounts for more than 55% of the market, becoming the biggest winner in the global smartphone CIS market, while Samsung accounts for more than 20% of the market, and Omnivision ranks third with about 7% of the share.

However, with the fluctuation of the industrial chain, market cycle adjustment, and technological evolution, the smartphone CIS market is quietly changing.

According to internal news from the industrial chain, domestic smartphone brands such as Huawei and Xiaomi have reached a consensus that in order to eliminate the hidden danger of chip "strangulation", they will gradually reduce or even give up cooperation with Sony and fully support domestic CIS manufacturers. For example, not long ago, Huawei P70 increased the order by 50%, demanding a large amount of stock of Omnivision CIS.

Not only that, an anonymous complaint from a mobile phone camera module manufacturer said, "Sony has completely tilted the best CMOS products and technologies towards Apple, which has already triggered a collective dissatisfaction among Android brand manufacturers. Once there are alternative products on the market, Sony's dominance will inevitably decline rapidly."At present, although Sony remains the dominant force in the mobile CIS field, in this round of CIS market recovery, a number of domestic CIS manufacturers have increased their market development efforts and are gradually forming a "stand-off" situation with Sony and Samsung.

50MP, the "sweet spot" of the mobile CIS market

For a long time, high-performance CIS has mainly been supplied by Sony and Samsung, especially the 50-megapixel (50MP) main camera CIS, which may become the "sweet spot" of the CIS market.

CICC, based on market research, clearly stated in the report: "64MP and 100 million-pixel products have not become the mainstream of the high-end CIS market. The mainstream high-end products have not infinitely increased the pixel count. We believe that most mobile phones' rear main cameras may remain at 50MP, and 64MP may gradually exit the historical stage."

At present, Sony's main 50-megapixel large pixel point CIS has more than 10 models, with pixel sizes ranging from 1.0um to 1.6um, and CIS sizes ranging from 1/1.56 inches to 1 inch.

Samsung focuses on high-resolution, small pixel point products in the flagship mobile phone main camera CIS solution, currently having 8 CIS with a resolution of 100 million pixels or more; in the 50M large pixel market, Samsung has only laid out 3 products, and the product line is less rich than Sony.

Under this situation, domestic CIS manufacturers are also actively deploying and have also opened up the high-end market in recent years.

At present, domestic CIS has made a breakthrough in the mainstream 50MP products. Domestic leading enterprises such as OmniVision, SmartSens, and GCO are also actively deploying 50MP CIS products.

OmniVision has now achieved a full series layout of 50M, released a 1/1.5 large bottom 50MP product OV50E in 2022, used for the rear main camera of mid-to-high-end smartphones; in 2023, it released an advanced version of the 1/1.3 large bottom product OV50H, aimed at the rear camera of high-end flagship mobile phones; in March 2024, it released a 1/1.3-inch 50MP, 1.2μm pixel size product OV50K40, which first used TheiaCel technology and took advantage of the LOFIC function, enabling the sensor to obtain a dynamic range close to the human eye level with only a single exposure.

In particular, OmniVision's OV50H is gradually becoming one of the important choices for the main camera of domestic mobile phone manufacturers. Since 2023, some mobile phone models of Xiaomi, Huawei, Honor, vivo, Meizu, and others, especially flagship products, have started to replace Sony CIS and turn to OmniVision's OV50H solution. Some supply chain insiders revealed that "the production capacity of OV50H this year has been fully booked."From the financial report of Weier Shares in 2023, it can be seen that the company's high-end smartphone CIS sales are strong. The revenue from the image sensor business from the smartphone market has risen to 7.779 billion yuan, an increase of 44.13% year-on-year. Among them, the revenue contribution ratio of products with 50 million pixels and above (including 64 million pixels, 100 million pixels, etc.) exceeds 60%.

In addition to Howei, Sitewei has also become another 50 million pixel CIS supplier for Chinese smartphone OEMs, and has started to provide high-resolution CIS products.

Aiming at the 50 million pixel product track, Sitewei launched two differentiated CIS products, SC550XS and SC520XS, in 2022, which can meet the needs of flagship smartphones, main cameras, front cameras, ultra-wide-angle, and telephoto cameras in terms of performance.

At the beginning of 2024, Sitewei once again launched its first 50 million pixel 1/1.28 inch image sensor SC580XS, which is an upgraded product built on the same process platform after the company successfully mass-produced the first 22nm HKMG Stack process 50 million pixel 1/1.56 inch product SC550XS.

In February of this year, Sitewei brought a 50MP resolution 0.7μm pixel size mobile image sensor SC5000CS. As a 0.702μm pixel size image sensor, it is equipped with unique technology, empowering mainstream smartphone main cameras and helping mobile imaging technology and user experience to reach new heights.

Sitewei's high-end CIS chips have entered the main camera market of flagship smartphones. According to the market share of the top 9 mobile CMOS manufacturers in 2023, Sitewei has successfully entered the top five globally, with a market share of 5.7%.

For many years, Geke Micro has been the champion of global mobile CIS annual shipments. In the first quarter of this year, Geke Micro's shipment ranking temporarily lags behind Sony and ranks first among domestic manufacturers.

However, looking at the key layout of the market, Geke Micro once dominated the supply of low-pixel products, but now it has started to provide high-resolution CIS products. Among them, the 32 million pixel product developed by Geke Micro based on high-pixel single-chip technology has been successfully mass-produced by brand customers, and two 50 million pixel products were launched at the beginning of this year, and are moving towards the high-pixel product field.

It is reported that the two latest 50MP high-end products released by Geke Micro represent two different paths of innovation:Small base, high-resolution path: GC50E0 is a 50MP product based on the 0.7µm platform and is the first single-chip 50-megapixel product on the market.

Large base, large-size path: GC50B2 is a 50MP product that uses 1.0µm pixels to achieve a large base of 1/1.56".

It is worth noting that the GCMOS CIS products use their own independently developed single-chip architecture, which is distinctly different from the mainstream stacked structure. The single-chip architecture can control heat, reduce power consumption, and reduce the area of the logic region, reducing the loss of yield.

With the launch of the 50MP product, it marks an extremely important step for GCMOS in the high-end CIS journey. It is reported that the current customer order situation is quite frequent, and this year GCMOS 50MP products will be used in multiple models of first-line brands.

Especially with GCMOS successfully transitioning from Fabless to Fablite in 2023, its Lingang factory has successfully landed, and the 12-inch CIS integrated circuit specialty process production line has been successfully connected. GCMOS has become one of the most powerful competitors in the domestic CIS camp.

Overall, under the wave of domestic substitution, domestic leading CIS manufacturers represented by Omnivision, SmartSens, and GCMOS have multiple advantages, the technology gap is narrowing, and domestic enterprises actively embrace the attitude of domestic manufacturers, which is in line with the national trend of technological import substitution and independent control.

It can be foreseen that in the field of mobile phone CIS, facing multiple development opportunities such as domestic substitution, market recovery, technological innovation, and diversified product demand, domestic CIS manufacturers are expected to occupy a more important position in the high-end mobile phone CIS market.

At the same time, in the nearly 20-year development history of smartphones, after multiple rounds of market fluctuations and baptism of terminal brands, the CIS supply pattern has basically taken shape, which is also an important sign of an industry moving towards maturity. Subsequently, in the continuously upgraded smartphone imaging battle, the CIS technology path has become a "public secret", and a comprehensive comparison of more extreme costs, more suitable products, more timely delivery, and more professional services is the key to the industry's ability to go far.

And this is exactly where domestic CIS manufacturers excel.

The "Dawn" of the Automotive CIS MarketDespite the impact of macroeconomic factors on most markets, the automotive sector, especially the new energy vehicle (NEV) sector, has maintained a rapid growth trend in sales under the global trend of electrification. With the iterative upgrade and widespread adoption of autonomous driving functions, the original equipment manufacturer (OEM) market is set to become the main driver of growth for automotive CMOS Image Sensors (CIS). The automotive sector has become the second-largest application market for CIS, following smartphones. According to ICV Tank forecasts, the automotive OEM CIS market is expected to grow to $5.131 billion by 2027.

The development potential of the automotive CIS market is enormous. However, entering and excelling in this market is not an easy task, mainly because the technological content of automotive CIS is significantly higher than that of smartphones and security applications. For instance, in-vehicle CIS requires higher stability and lifespan compared to consumer products, necessitating stringent automotive-grade certification. Automotive CIS must have stronger light sensitivity to ensure that in-vehicle cameras can function normally at night and in tunnels. High Dynamic Range (HDR) is generally required, with the dynamic range of automotive CIS typically ranging from 120 to 140 dB (compared to the 60 to 70 dB range for smartphone CIS), to ensure that in-vehicle cameras can adapt to drastic changes in lighting and capture high-quality images. LED Flicker Mitigation (LFM) requires CIS manufacturers to have suppression technology to avoid misjudgment caused by frequency mismatch between CIS and LED traffic lights.

Yole analysts point out that in the automotive CIS sector, ON Semiconductor holds about 40% of the market share, but its market share is declining year by year. Next is OmniVision, with a 28% market share. Sony and Samsung are competitively priced, leveraging their consumer production capabilities to expand their product portfolios with new automotive products.

Just as 50-megapixel is the "sweet spot" for smartphones, influenced by the rapid evolution of advanced intelligent driving technologies such as high-speed NoA and urban NoA, 8-megapixel products are the battleground for all CIS manufacturers.

ON Semiconductor: Leading the Automotive CIS Market Amid Intensifying Competition

In the automotive CIS field, ON Semiconductor has a high market position. This business achieved revenue of $1 billion in its fiscal year 2023, with a design win growth of over 50% year-on-year. Its 8-megapixel image sensors and automotive LED lighting products have been growing strongly, leading the automotive CIS market.

In May last year, ON Semiconductor launched the Hyperlux automotive image sensor series, featuring a 2.1µm pixel size, 150dB ultra-high dynamic range, and LFM capabilities, covering products from 3 megapixels to 8 megapixels and higher. The Hyperlux product series has solidified ON Semiconductor's position as a leader in automotive-grade CIS with industry-leading ultra-low power consumption and small size.

Compared to competitors, these automotive CIS have up to 30% lower power consumption and up to 28% smaller footprint, enabling high-efficiency design with lower system material costs.Facing the development prospects of the automotive market, major CIS manufacturers have all bid against ON Semiconductor.

Sony stated at its performance briefing that its goal is to occupy 39% of the market share by the fiscal year of 2025, a significant increase from the 9% share in the fiscal year of 2021, challenging ON Semiconductor's market position. Currently, Sony is leading the Japanese market, and its joint venture with Honda is planning to launch an electric vehicle named Afeela equipped with more than 20 cameras (currently, Tesla Model 3 is equipped with 8 cameras).

Samsung's semiconductor division LSI stated in April 2023 that its high-pixel automotive CIS it launched will become the "ultimate weapon" to surpass Sony. It is reported that Samsung has signed supply contracts with several undisclosed automotive companies and will soon start mass production.

Perceiving the ambitions of Sony and Samsung, ON Semiconductor did not sit idly by but quickly visited Japan to conduct business discussions with automotive customers. ON Semiconductor stated that it plans to start producing some CIS in Japan in 2024 to stabilize the supply chain, while also promoting the advantages of its "smart sensing" technology and HDR technology, as well as the LED flicker-free function.

Omnivision: The market share of automotive CIS continues to increase

According to institutional research in October 2023, Omnivision's automotive CIS shipments in the European and American markets both grew by more than 10% year-on-year in the second and third quarters of 2023. The main reasons are, on the one hand, the alleviation of shortages, and on the other hand, the increase in sales of mainstream models, such as the obvious increase in volume of products like surround view, L2 ADAS, and cabin driver monitoring.

Omnivision stated that the automotive CIS is in the process of climbing and increasing in volume, and it is expected that the sales volume of automotive CIS in some areas in 2024 will be more evident, and the market share is expected to continue to increase. According to the financial report of Weier Shares (the parent company of Omnivision Technology) in 2023, the revenue from CIS in the automotive market increased to 4.557 billion yuan, a year-on-year increase of 25.15%, ranking second in the world.

In terms of products and technology, Omnivision launched the latest SinglePixel LOFIC technology, which is widely used in automotive industry autonomous driving in-vehicle camera systems with ultra-high dynamic range capture capabilities, to deal with complex scenarios such as passing through tunnels and night scene lighting.

According to the news previously released by Omnivision, before 2022, only Omnivision in China had the ability to mass-produce ASIL-B and ASIL-C certified chips. The main ASIL-C series products of Omnivision include OX08B40/OX03F10/OX03C10, etc.; Omnivision also launched a series of ASIL-B certified products such as OX05B1S/OX03J10/OX03D4C/OX01F, covering a wide range of fields such as ADAS/AD and rearview imaging, with a broad market prospect.

In January of this year, Omnivision released a high-performance OX01J image sensor, with 1.3 million pixels suitable for automotive 360-degree surround view systems (SVS) and rearview cameras (RVC), providing excellent LFM, HDR, and low-light performance for the next generation of vehicles, meeting the needs of different users.Sitway: Deeply Engaged in Automotive CIS for Years

In fact, apart from the security and smartphone markets, Sitway has also performed well in the automotive CIS market. In 2022, Sitway held approximately 4% of the global automotive CIS market share. Its products cover cabin interior, exterior, surround view, and ADAS applications, with resolutions ranging from 1 megapixel to 8 megapixels, and have passed automotive standards certification, establishing a comprehensive automotive-grade chip R&D and quality management system.

Looking back at its development history, it can be seen that Sitway has actually been in the automotive CIS market for many years.

As early as 2019, the first automotive-grade front-end CIS chip designed by Sitway marked its official entry into the in-vehicle market, and it also specifically set up a vehicle chip department.

At the end of 2019, Sitway acquired 5 patents and 7 integrated circuit layout designs from the automotive CIS manufacturer Shenzhen Anxin Micro, forming a new intelligent vehicle electronics team together with the company's original team.

At the end of 2022, Sitway released a new 8-megapixel automotive-grade image sensor product, SC850AT. With this innovative product, Sitway has become one of the few companies capable of meeting the demand for high-pixel image sensors by advanced intelligent driving technology.

In 2023, Sitway launched the SC233AT and SC130AT for cabin applications, and in March 2024, it launched a new 1.3MP automotive-grade image sensor product - SC130AT.

Sitway's core technology includes the automotive LED flicker suppression (LFS) patent technology, which can effectively suppress LED flicker through multiple exposures, in-chip multi-frame synthesis, and the support of quaternary pixel technology, while providing HDR of more than 120dB, reducing the misjudgment caused by LED signal light flickering in video images, and enabling the presentation of light and dark details under the two extreme light contrast scenarios of daytime cabin and exterior scenes.

Sitway has released and mass-produced a variety of high-performance automotive-grade CIS products for the automotive application field, and at the same time, it has also started a comprehensive plan for the next generation of automotive CIS products, covering applications such as automotive imaging, ADAS, and cabin DMS, OMS, and DVR applications.

According to Sitway's financial report disclosure, its automotive CIS products have been successfully applied to projects of many car manufacturers, including BYD, FAW, SAIC, Dongfeng Nissan, Great Wall, Zero Run, and Lan Tu, and have begun mass production.GalaxyCore: Breaking into the Automotive Field

GalaxyCore has been making strides in breaking into the automotive field in recent years. According to the head of GalaxyCore's non-mobile CIS business division, the company will launch its first product truly developed according to automotive standards in 2024.

"In terms of the in-vehicle electronics market, we will continue to follow our previous approach, gradually moving from low-end to high-end, and moving forward steadily and solidly," said the head. "In the next few years, our front-end automotive products will flood the market. In addition, the digital business division will not be limited to the front-end automotive field; we also plan to expand into industrial products and other fields."

The strategic goal of transitioning from Fabless to Fablite has been successfully achieved, and GalaxyCore will use this as a foundation to strive for a new strategy. The high-end layout is supported by the Fablite model, which will greatly enhance the advancement speed of in-vehicle CIS, improve the R&D efficiency of GalaxyCore, and provide stronger support for the company's innovation and development.

The potential of in-vehicle CIS is enormous. How can domestic manufacturers exert their strength?

According to industry insiders, the different stages of industrial development have also created different upstream and downstream relationships. Nowadays, in the field of smartphone CIS, to maximize product photography performance, upstream and downstream manufacturers (mobile phone manufacturers and CIS manufacturers) will reach product customization or joint R&D relationships. However, domestic car manufacturers are currently too busy to pay attention to joint R&D with in-vehicle CIS manufacturers.

Therefore, in the case of insufficient product and brand accumulation, if domestic in-vehicle CIS manufacturers want to occupy a place in this market, or even challenge the leading position of ON Semiconductor, they should focus on these three points: 1) product cost-effectiveness, 2) supply stability, and 3) agile development capabilities.

In terms of cost-effectiveness, affected by factors such as the last round of global chip shortages and rapid growth in downstream demand, since the middle of 2021, ON Semiconductor has raised the price of automotive CIS products several times, leaving a certain market space for more domestic in-vehicle CIS manufacturers who win by cost-effectiveness.

In addition to product cost-effectiveness, car manufacturers are also very concerned about the large-scale supply capabilities of in-vehicle CIS manufacturers. In this regard, the transformation from Fabless to Fablite, represented by GalaxyCore, has strengthened the freedom and say in production capacity and supply.

Furthermore, as the automotive industry is becoming more "competitive," in-vehicle CIS manufacturers also need to improve the agility of product development to better adapt to the product launch rhythm of downstream customers. In this regard, domestic in-vehicle CIS manufacturers, due to their short decision-making processes, closer proximity to the Chinese market and customers, and a greater focus on customer real needs in R&D, can carry out targeted R&D and optimization for specific needs in some segmented scenarios, and will have certain advantages.In summary, in the current trend of electrification and intelligence in the automotive industry that is unstoppable, the automotive CIS industry is ushering in a period of rapid growth. In the rapidly developing stage of the market, which automotive CIS manufacturer can better meet the supply needs of domestic mainstream new energy vehicle manufacturers, who will stand out in the Chinese market.

The opportunities faced by domestic manufacturers are generally greater than the challenges.

Overall, in recent years, domestic CIS chip suppliers are rapidly converging from non-automotive fields such as mobile phones and security to the automotive industry. Market competition has begun to intensify and drive changes in the market structure. Domestic manufacturers represented by OmniVision, SmartSens, and GalaxyCore are increasing their investment in the automotive CIS field, and their market share is gradually increasing.

In addition to the aforementioned companies, within the domestic scope, there are also manufacturers such as Yonsung, BYD Semiconductor, Changchun Optoelectronics, Guangzhou Yinxin, Rui Xin Micro, Weiguang Jidi, Xinshi, Haitian Microelectronics, Chuangshi Microelectronics, and SiPiKe, which also have layout in the automotive CIS field, but the current market share is not too high.

CIS is expected to achieve domestic substitution first

Looking back at the history of the global CIS industry, it is like a tense and fierce competition.

At present, manufacturers such as Sony, Samsung, and ON Semiconductor occupy the first opportunity, and their high-tech products fully exert advantages in new high-end mobile phones and automotive applications.

In this process, domestic CIS manufacturers represented by OmniVision, SmartSens, and GalaxyCore have launched a breakthrough and have achieved a larger market share in some downstream markets. At the same time, facing the basic market of the mobile phone market and the market potential of the automotive track, these domestic CIS manufacturers are also striving to seize market and era opportunities, actively seeking to catch up and break through in high-end materials and high-growth fields.

In the future, with the maturity and gradual popularization of emerging technologies and applications, the incremental market of CIS will further expand and maintain a long-term upward trend.

Domestic leaders are deeply rooted and steady, and CIS is expected to achieve domestic substitution first. According to Gartner's forecast, CIS is expected to become one of the first semiconductor categories in which China will occupy more than 10% of the global market share.

Comments